By 7051275521

•

January 5, 2026

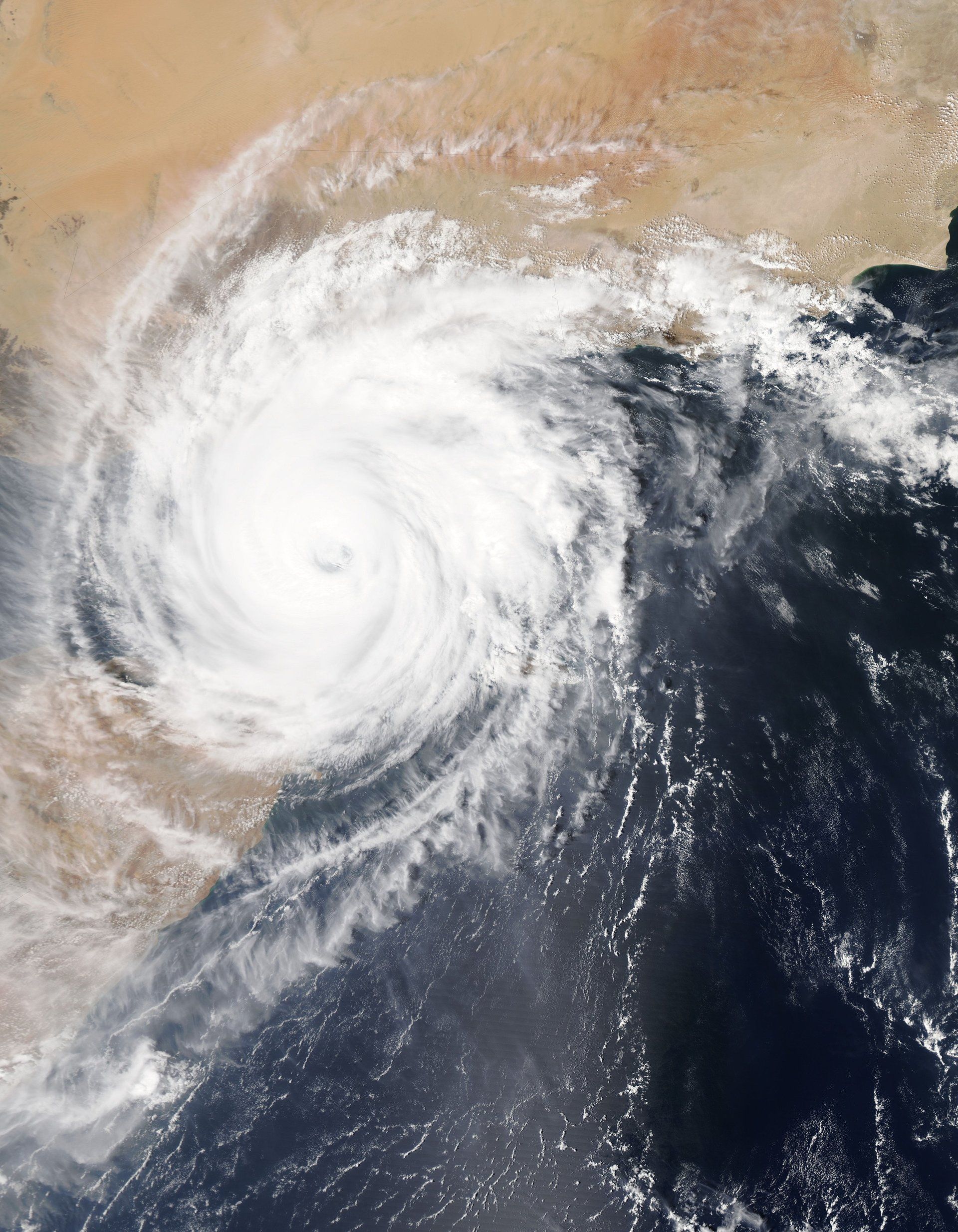

January is a month of fresh starts. While much of the country is shoveling snow, Floridians are enjoying mild weather, cool breezes, and the perfect time to reset, reorganize, and prepare for the year ahead. And believe it or not, January is one of the smartest months to review your insurance coverage. Whether you’re a homeowner, renter, business owner, or simply looking to protect your family, the beginning of the year offers a clean slate to make sure your policies still fit your life. 🏡 1. Review Your Homeowners Insurance Before Storm Season Sneaks Up Hurricane season may feel far away, but it always arrives faster than expected. January is the ideal time to: Reassess your dwelling coverage Update your inventory of personal belongings Check for gaps in wind or flood protection Confirm your deductible options Many homeowners don’t realize that flood insurance has a 30‑day waiting period , so early preparation is key. 🚗 2. Revisit Your Auto Insurance as Rates Shift in Florida Florida’s auto insurance market has seen significant changes in recent years. January is a great time to: Compare rates Review your liability limits Add roadside assistance Consider uninsured motorist coverage If you bought a new car over the holidays, now is the time to make sure it’s properly insured. 🏢 3. Business Owners: Start the Year With a Coverage Checkup Florida’s business landscape is growing fast, and so are the risks. A January insurance review can help you: Update your general liability or professional liability coverage Reassess property values Add cyber liability protection Review workers’ compensation needs A quick annual check can prevent costly surprises later. 🌧 4. Don’t Forget Flood Insurance — Even in the Dry Season Many Floridians are surprised to learn that 20% of flood claims come from low‑risk areas. January’s dry weather makes it easy to forget the heavy rains that come later in the year. If you don’t have flood insurance, now is the perfect time to explore your options. 👨👩👧 5. Life Insurance: A New Year, New Priorities January often brings resolutions about family, finances, and long‑term planning. Life insurance is one of the most meaningful ways to protect the people you love. Consider reviewing your policy if you’ve recently: Bought a home Had a child Changed jobs Started a business A quick conversation can ensure your coverage matches your goals. ✨ Start the Year Confident and Protected January is more than a new month — it’s a chance to reset your protection, strengthen your financial security, and make sure your insurance truly fits your life in Florida. Reach out now to review your policies or explore new coverage options—our experts will guide you every step of the way and ensure you get the protection you need, stress-free. Here’s to a safe, secure, and successful year ahead.