National Flood Insurance Program What You Need To Know

Myths and Facts About The National Flood Insurance Program

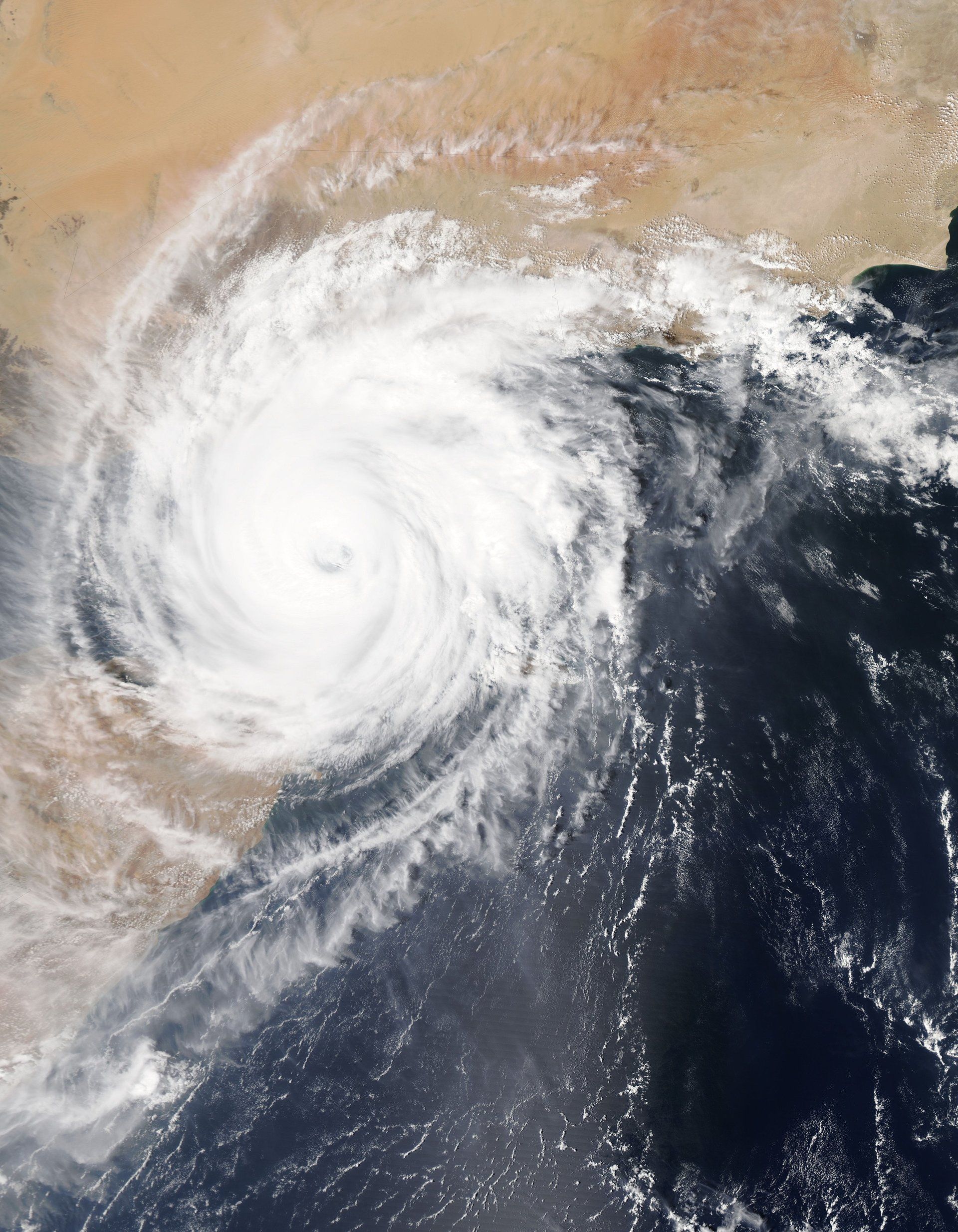

WELCOME BACK! By now you should know more about flood insurance than most people. I thought it is appropriate to continue this discussion in light of what is happening on the gulf coast as people deal with the effects of CINDY.

MYTH: Flood Insurance is only for homeowners.

Fact:

Most people who live in NFIP participating communities, including renters and condo unit owners, are eligible to purchase a federally back flood insurance. A maximum of $250,000.00 of building coverage is available for single family residential buildings; $250,000.00 per unit for residential condominiums. The limit for contents coverage on all residential buildings is $100,000.00, which is also available to renters.

Commercial structures can be insured to a limit of $500,000.00 for the building and $500,000.00 for the contents. The maximum insurance limit may not exceed the insurable value of the property.

Myth: You cannot buy flood insurance if your property has been flooded.

Fact:

You are still eligible to purchase flood insurance after your home, apartment, or business has been flooded, provided that your community is participating in the NFIP. Any flooding and claims that occurred before the inception of the new policy is not a covered loss.

We have seen how erratic the weather can be and how fast flooding occurs in ANY AREA. Do not be caught in thinking that because your property in not in a flood zone, that your property is not at risk.

Until the next time, ask me questions. We are here for you. Evella