Florida Insurance Tips for the Holidays: Protect What Matters Most This December

7051275521 • December 19, 2025

Protect What Matters Most This December

The holiday season in Florida is all about sunshine, family gatherings, and festive celebrations—but it’s also a time when unexpected risks can sneak up on you. From holiday travel to home safety, December is the perfect time to review your insurance coverage and make sure you’re protected. Here are some essential tips to keep your peace of mind intact this season.

1. Protect Your Home During Holiday Travels

Heading out of town? Make sure your homeowners or condo insurance is up to date.

Check for water damage coverage: Florida homes can still face plumbing issues even in winter.

Secure your property: Install smart locks or cameras for added security.

Tip: If you’re hosting guests, confirm your liability coverage in case of accidents.

2. Auto Insurance for Holiday Road Trips

December means busy roads and holiday traffic.

Review your uninsured motorist coverage: Florida has a high rate of uninsured drivers.

Consider roadside assistance: A flat tire or dead battery can ruin your holiday plans.

Tip: If you’re renting a car, check if your policy covers rental vehicles.

3. Protect Your Holiday Gifts

Did you splurge on jewelry or electronics?

Update your personal property coverage: Standard homeowners policies may have limits on high-value items.

Consider a personal articles floater for expensive gifts like engagement rings or luxury watches.

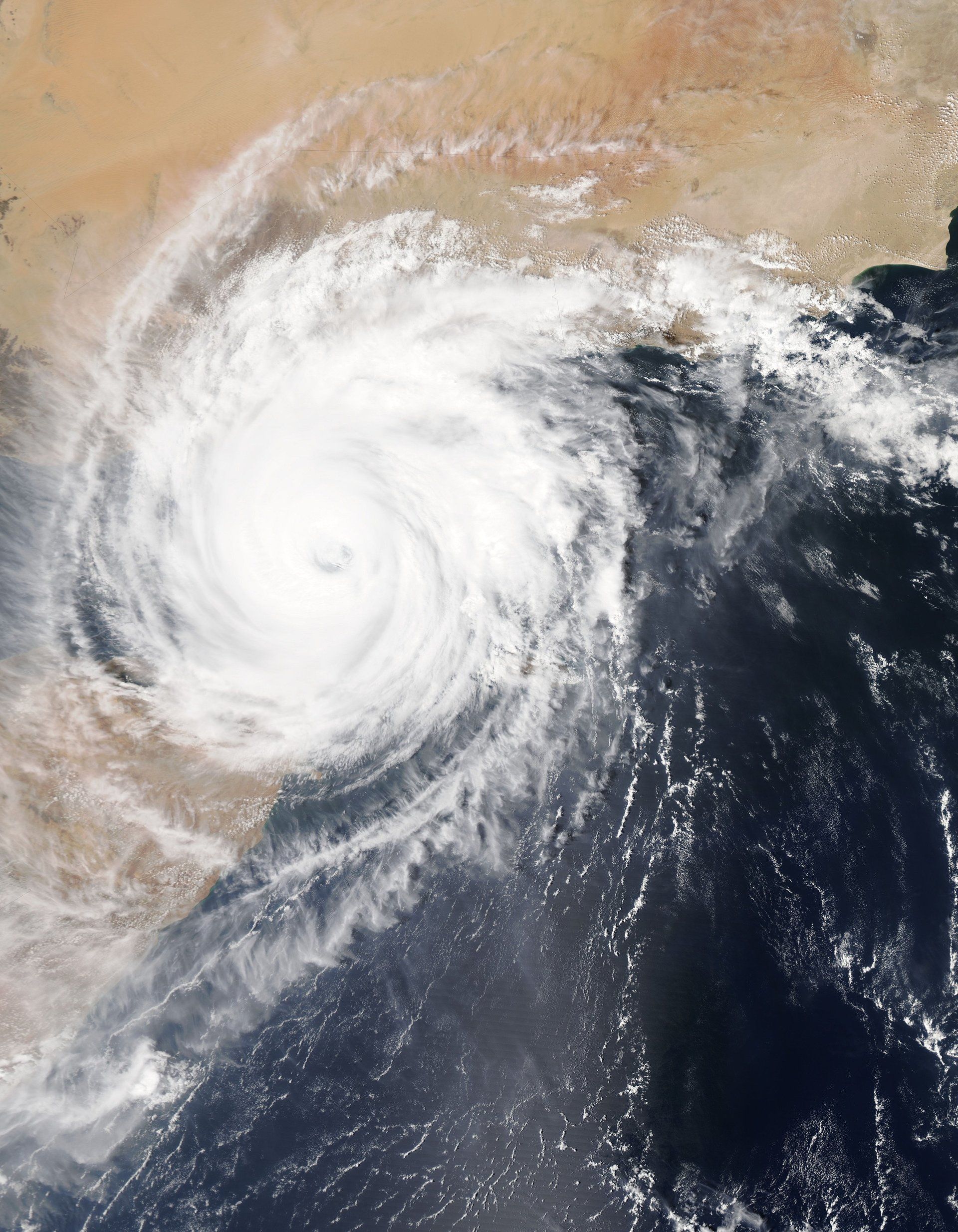

4. Flood Insurance Reminder

Even in December, Florida weather can surprise us.

Flood risk doesn’t take a holiday: Heavy rains can happen year-round.

Tip: If you don’t have flood insurance, now is the time to ask about it.

5. Year-End Insurance Checkup

The new year is around the corner—perfect time to review your policies.

Bundle and save: Combine auto and home for discounts.

Update coverage: Life changes like buying a home or adding a new car should be reflected in your policy.

Ready to make sure your coverage is holiday-proof?

Contact AutoLife Group today for a free insurance review at 941-210-4499. Let us help you start the new year with confidence and peace of mind.

January is a month of fresh starts. While much of the country is shoveling snow, Floridians are enjoying mild weather, cool breezes, and the perfect time to reset, reorganize, and prepare for the year ahead. And believe it or not, January is one of the smartest months to review your insurance coverage. Whether you’re a homeowner, renter, business owner, or simply looking to protect your family, the beginning of the year offers a clean slate to make sure your policies still fit your life. 🏡 1. Review Your Homeowners Insurance Before Storm Season Sneaks Up Hurricane season may feel far away, but it always arrives faster than expected. January is the ideal time to: Reassess your dwelling coverage Update your inventory of personal belongings Check for gaps in wind or flood protection Confirm your deductible options Many homeowners don’t realize that flood insurance has a 30‑day waiting period , so early preparation is key. 🚗 2. Revisit Your Auto Insurance as Rates Shift in Florida Florida’s auto insurance market has seen significant changes in recent years. January is a great time to: Compare rates Review your liability limits Add roadside assistance Consider uninsured motorist coverage If you bought a new car over the holidays, now is the time to make sure it’s properly insured. 🏢 3. Business Owners: Start the Year With a Coverage Checkup Florida’s business landscape is growing fast, and so are the risks. A January insurance review can help you: Update your general liability or professional liability coverage Reassess property values Add cyber liability protection Review workers’ compensation needs A quick annual check can prevent costly surprises later. 🌧 4. Don’t Forget Flood Insurance — Even in the Dry Season Many Floridians are surprised to learn that 20% of flood claims come from low‑risk areas. January’s dry weather makes it easy to forget the heavy rains that come later in the year. If you don’t have flood insurance, now is the perfect time to explore your options. 👨👩👧 5. Life Insurance: A New Year, New Priorities January often brings resolutions about family, finances, and long‑term planning. Life insurance is one of the most meaningful ways to protect the people you love. Consider reviewing your policy if you’ve recently: Bought a home Had a child Changed jobs Started a business A quick conversation can ensure your coverage matches your goals. ✨ Start the Year Confident and Protected January is more than a new month — it’s a chance to reset your protection, strengthen your financial security, and make sure your insurance truly fits your life in Florida. Reach out now to review your policies or explore new coverage options—our experts will guide you every step of the way and ensure you get the protection you need, stress-free. Here’s to a safe, secure, and successful year ahead.

I am back for the last 2 series of this our Blog Topic. So, what else do you know or not know about flood insurance? Myth: The NFIP does not offer any type of basement coverage. Fact: Yes it does. The NFIP defines a basement as any area of a building with a floor that is below ground level on all sides. While flood insurance does not cover basement improvements (such as finished walls, floors, or ceilings) or personal belongings kept in a basement (such as furniture and other contents), it does cover structural elements and essential equipment. The following items are covered under building coverage, as long as they are connected to a power source, if required and installed in their functioning location: - Sump pumps - Well water tanks and pumps, cisterns, and the water in them - Oil tanks and the oil in them, natural gas tanks and the gas in them - Pumps and/or tanks used in conjunction with solar energy - Furnaces, water heaters, air conditioners, and heat pumps - Electrical junction and circuit breaker boxes and required utility connections - Foundation elements - Stairways, staircase, elevators, and dumbwaiters - Unpainted drywall walls and ceilings, including nonflammable insulation The following are covered under contents coverage: - Clothes washers and dryers - Food freezers and the food in them The NFIP recommends both building and contents coverage for the broadest protecttion. Myth: The NFIP encourages coastal development. Fact : One of the NFIP's primary objectives is to guide development away from high flood risk areas. NFIP regulations minimize the impact of structures that are built in SFHA's by requiring them not to cause obstructions to the natural flow of floodwaters. Also as a condition of community participation in the NFIP, those structures built within SFHA's must adhere to strict floodplain management regulations enforced by the community. In addition, the Coastal Barrier Resources Act (CBRA) of 1982 relies on the NFIP to discourage building in fragile coastal areas by prohibiting the sale of flood insurance in designated CBRA areas. While the NFIP does not prohibit property owners from building in their areas, any Federal financial assistance, including federally backed flood insurance, is prohibited. However, the CBRA does not prohibit privately financed development or insurance. You should have some questions by now. Call us at 941-210-4499, we are happy to help.

We are half way through our series about Flood Insurance. You must have some questions or comments by now, we are to answer them for you. Myth: Only residents of high-flood risk areas need to insure their property. Fact: All areas are susceptible to flooding, although to varying degrees. If you live in a low-to-moderate flood risk area, it is advisable to have flood insurance. Nearly 20% of the NFIP's claims come from outside high-flood risk areas. This percentage may have risen during the last 2 years. Residential and commercial property owners located in low-to-moderate risk areas should ask their agents if they are eligible for the Preferred Risk Policy, which provides inexpensive insurance protection. Myth: National Flood Insurance can only be purchased through the NFIP directly . Fact: NFIP flood insurance is sold thru private insurance companies and agents, and it is backed by the federal government. It is very true that most people might perceive flood insurance as expensive. If your property is located in a preferred area, it could be as low as $460.00 per year. Until the next time, be safe. Evella

WELCOME BACK! By now you should know more about flood insurance than most people. I thought it is appropriate to continue this discussion in light of what is happening on the gulf coast as people deal with the effects of CINDY. MYTH: Flood Insurance is only for homeowners. Fact: Most people who live in NFIP participating communities, including renters and condo unit owners, are eligible to purchase a federally back flood insurance. A maximum of $250,000.00 of building coverage is available for single family residential buildings; $250,000.00 per unit for residential condominiums. The limit for contents coverage on all residential buildings is $100,000.00, which is also available to renters. Commercial structures can be insured to a limit of $500,000.00 for the building and $500,000.00 for the contents. The maximum insurance limit may not exceed the insurable value of the property. Myth: You cannot buy flood insurance if your property has been flooded. Fact: You are still eligible to purchase flood insurance after your home, apartment, or business has been flooded, provided that your community is participating in the NFIP. Any flooding and claims that occurred before the inception of the new policy is not a covered loss. We have seen how erratic the weather can be and how fast flooding occurs in ANY AREA. Do not be caught in thinking that because your property in not in a flood zone, that your property is not at risk. Until the next time, ask me questions. We are here for you. Evella

Welcome back to our continuing series of Myths and Facts about Flood Insurance. We will cover 2 the most common myths : Myth: You cannot buy flood insurance immediately before of during a flood. Fact: You can purchase national Flood Insurance at any time. There is usually a 30-day waiting period after premium payment before the policy is effective, with the following exceptions: 1) If the initial purchase of flood insurance is in connection with making, increasing, extending, renewing of a loan, there is no waiting period. Coverage becomes effective at the time of the loan, provided application and payment of premium is made at or prior to loan closing. 2) If the initial purchase of flood insurance is made during the 13-month period following the effective date of a revised flood map for a community, there is a 1 day waiting period. This applies only where the Flood Insurance Rate Map (FIRM) is revised to show the building to be in a Special Flood Hazard Area (SFHA) when it had not been in an SFHA. The policy does not cover a "loss in progress" defined by the NFIP as a loss occurring as of 12:01 a.m. on the very first day of the policy term. In addition, you cannot increase the amount of insurance coverage you have during a loss in progress. Myth: Homeowners Insurance Policies cover flooding. Fact: Unfortunately, many home and business owners do not find out until is too late that their homeowners insurance and business multi-peril policies do not cover flooding. The NFIP offers a separate policy that protects the single most important financial asset, which most people is their home and business. Homeowners can include contents coverage in their NFIP policy. Residential and commercial renters can purchase contents coverage. Business owners can purchase flood insurance coverage for their buildings and contents/inventory and, by doing so, protect their livelihood. Thank you for stopping by, as always we are here for you. Your comments are welcome. Until next time, be safe. Evella

In these series I will address Myths and Facts about the National Insurance Program. For the following week, I will publish excerpts of very important things you should know about flood, flooding and the Federal Emergency Management Administration (FEMA). Contents courtesy of NFIP. DAY ONE: WHO NEEDS FLOOD INSURANCE? EVERYONE! And almost everyone in a participating community of the National Flood Insurance Program (NFIP) can buy flood insurance. Nationwide, more than 20,000 communities have joined the program. In some instances, people have been told that they cannot buy flood insurance because of where they live. To clear this up and other misconceptions about National Flood Insurance, the NFIP has compiled a list of common myths about the program, and the real facts behind them, to give you the full story about this valuable protection. MYTH: YOU CANNOT BUY FLOOD INSURANCE IF YOU ARE LOCATED IN A HIGH-FLOOD RISK AREA. FACT: You can buy flood insurance no matter where you live if your community participates in the NFIP, except in Coastal Barrier Resources Systems (CBRS) or other protected areas. The program was created in 1968 to make federally backed flood insurance available to property owners who live in eligible communities. Flood insurance was then virtually unavailable from the private insurance industry. The flood disaster act of 1973, as amended, requires federally regulated lending institutions to make sure that mortgage loans secured by buildings in high flood risk areas are protected by flood insurance. Lenders should notify borrowers prior to closing that their property is located in a high-flood risk area and that National Flood Insurance is required. As a current update: There are now several private insurance carriers who offers flood insurance to consumers. If you have questions or comments, please respond below in a professional and respectful way and I will address them. Until tomorrow for the next Myth and Fact. Make today a good day. We are here for you, Evella

1) Start with the right homeowners insurance and flood insurance protection: Visit www.autolifegroup.com 2) Know your communities severe weather warning system and follow new reports closely. 3) Identify escape routes from your home and neighborhood. 4) Research the evacuation plans for your workplace and children's schools. 5) Designate an emergency meeting place for your family. 6) Plan and decide where you and your pets can take shelter when necessary. 7) Establish a contact point to communicate with concerned relatives and friends. There is an app for that. 8) Take a video and pictures of your home inside and outside. Meticulously record upgrades and valuables. 9) Have drinking water and emergency kit prepared and ready to go. 10) Fill your bathtub with water that can be used for flushing toilets and or for washing. We are here for you.