National Flood Insurance Program What you Need to Know

Myths and Facts about the National Flood Insurance Program

Here are the last 2 Myths and Facts on my Blog Series.

MYTH: Federal disaster assistance will pay for flood damage.

FACT:

Before a community is eligible for disaster assistance, it must be declared a federal disaster area. Federal disaster assistance declarations are issued in less that 50% of flooding events. The premium for an NFIP policy of a property in a preferred area is averaging less that 500 a year. and can be a lot less expensive than the monthly payments on a federal disaster loan. Yes, federal disaster assistance is not FREE.

Furthermore, if you are uninsured and receive disaster assistance after a flood, you must purchase flood insurance to remain eligible for future disaster relief.

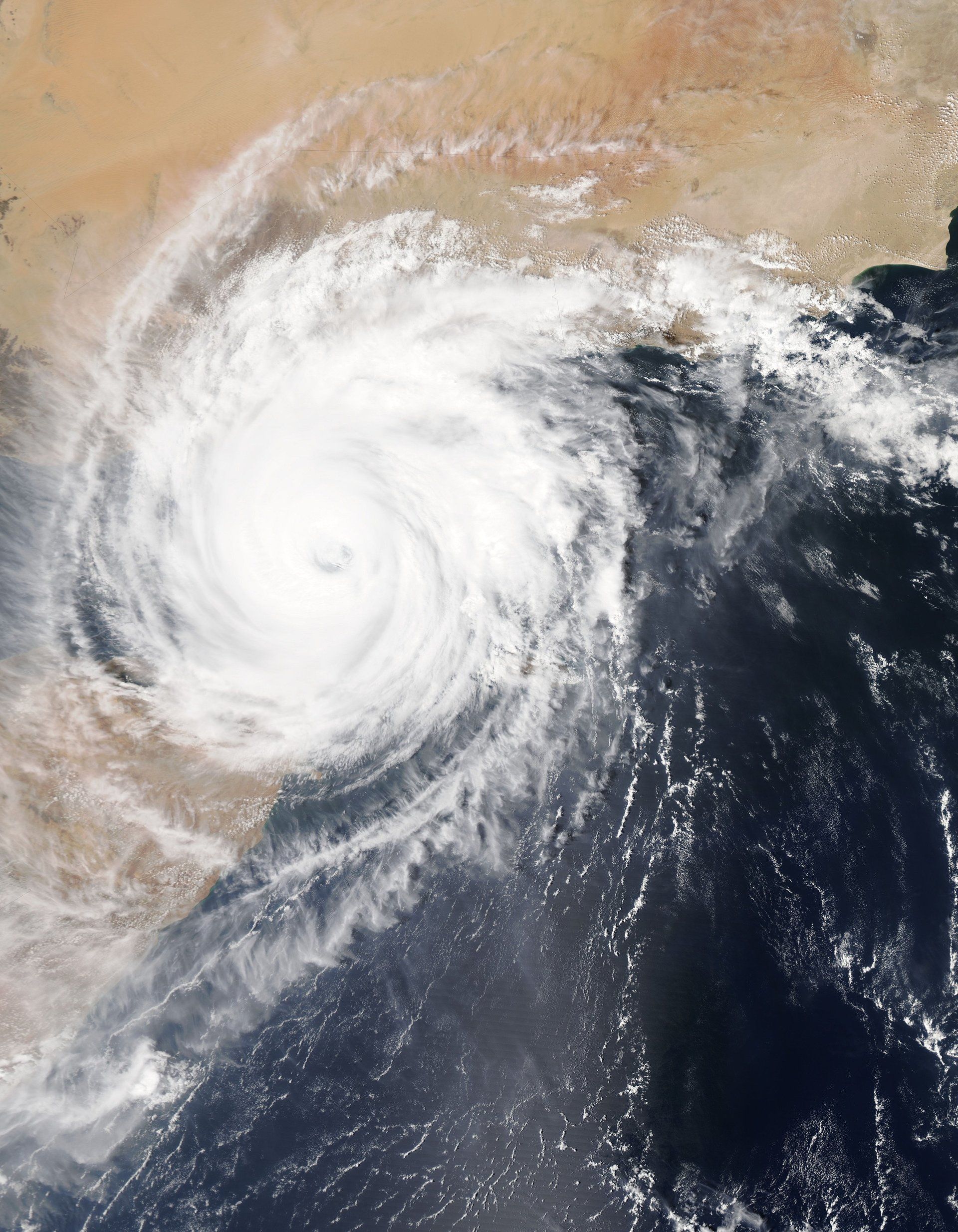

MYTH: The NFIP does not cover flooding resulting from hurricanes or the overflow of rivers or tidal waters.

FACT:

The NFIP defines covered flooding as a general and temporary condition which the surface of a normally dry land is partially or completely inundated. Two properties in the area or two or more acres must be affected. Flooding can be cause by:

- overflow of inland or tidal waters, or

- unusual or rapid accumulation or runoff of surface waters from any source, such as heavy rainfall, or

- mudflow, i.e. a river of liquid and flowing mud on the surfaces of normally dry land areas, or

- collapse or subsidence of land along the shore of a lake or other body of water, resulting from erosion or the effect of waves, or water currents exceeding normal, cyclical levels.

I conclude our Blog Series. Thank you all for stopping by. Be safe, be well.